Flutter Entertainment, the powerhouse behind FanDuel, just dropped a bombshell earnings report that has Wall Street buzzing. The company revealed full-year 2025 revenue of $16.4 billion, a solid 17% jump from last year, but it fell short of the $16.7 billion forecast. Worse yet, shares plunged over 14% as fears mount that rising prediction markets are chipping away at the core sports betting business. Investors are left wondering if this signals a seismic shift in how Americans wager on games.

Flutter kicked off the year with high hopes after strong growth in prior periods. The full-year revenue hit $16.4 billion, marking that 17% increase year over year. This figure came from robust activity across its global operations, with the U.S. segment leading the charge through FanDuel’s dominance in sports betting and online gaming.

Adjusted EBITDA climbed 21% to $2.8 billion, showing healthy profit margins despite the revenue shortfall. In the fourth quarter alone, group revenue surged 25% to help push the annual total. However, the miss against earlier guidance of $17.3 billion set off alarms. Analysts had adjusted expectations down to $16.7 billion by late 2025, but even that proved too optimistic.

The company pointed to softer-than-expected sports betting handle in the U.S. as a key drag. Handle, which measures total bets placed, grew just 3% in Q4 for FanDuel’s sports division. This slowdown contrasted with revenue up 35% in that segment, thanks to better margins hitting 8.9% on NFL bets.

The Growing Threat of Prediction Markets

Prediction markets are shaking up the gambling world in ways few saw coming. Platforms like Kalshi and Polymarket let users bet on real-world events, from election outcomes to sports results, but they operate more like financial exchanges than traditional sportsbooks. These sites are pulling bets away from giants like FanDuel, with activity surging during big events like the NFL playoffs and Super Bowl.

Kalshi, a federally regulated exchange, saw massive spikes in trading volume last season. Polymarket, popular for its crypto ties, reported hundreds of millions in bets on sports-related contracts. During the Super Bowl in early 2026, these platforms handled bets that rivaled traditional apps, drawing users with lower fees and broader options.

Traditional sportsbooks face stiff competition because prediction markets offer yes/no contracts on outcomes, often with better odds driven by crowd wisdom. Gambling stocks, including Flutter, have taken hits as investors fret over lost market share. DraftKings, a close rival, saw its shares drop 39% this year amid similar concerns.

Flutter’s CEO downplayed the immediate threat during the earnings call. Still, the company plans to invest $200 million to $300 million in its own prediction market features to fight back.

FanDuel’s Role in the US Sports Betting Boom

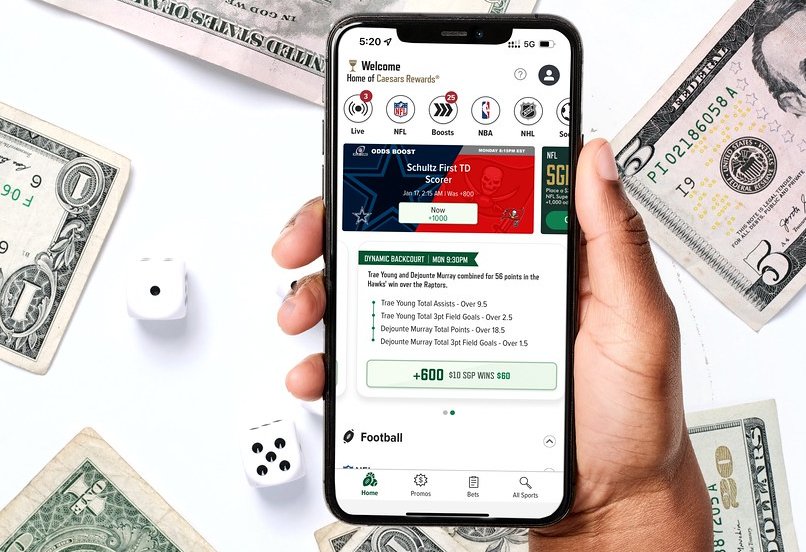

FanDuel remains the top dog in the U.S. sports betting arena, holding about 40% market share in a sector worth roughly $14 billion annually. Since launching in 2018, it has grown alongside the legalization wave across states, now available in over 20 markets. The brand’s app boasts user-friendly features that keep bettors coming back for live odds and promotions.

In 2025, FanDuel drove most of Flutter’s U.S. growth, with online gaming revenue soaring. Sports betting alone contributed billions, fueled by popular leagues like the NFL and NBA. Yet, the recent earnings highlight cracks: Sustained bettor losses and mistimed promotions led to slower engagement.

To illustrate the market dynamics, consider this table of key U.S. sports betting metrics for 2025:

| Metric | 2025 Value | Year-over-Year Change |

|---|---|---|

| Total Market Size | $14 billion | +12% |

| FanDuel Market Share | 40% | Steady |

| Average Monthly Users | 5 million | +8% |

| NFL Betting Volume | $4.5 billion | +15% |

This data, drawn from industry trackers like the American Gaming Association in late 2025, shows steady expansion but hints at saturation.

Prediction markets aren’t yet a huge cannibalizer for FanDuel, per company statements. But with platforms like Kalshi focusing on college basketball and NFL, the overlap is growing fast.

Investor Reactions and 2026 Outlook

Wall Street reacted swiftly to the news, with Flutter’s shares tumbling 14.5% in after-hours trading on February 27, 2026. This drop erased billions in market value, reflecting deep worries about the future. Analysts cut price targets, citing the revenue miss and cautious guidance as red flags.

For 2026, Flutter forecasts revenue of $18.4 billion, a modest 12% rise from 2025. That’s below the consensus estimate of $19.3 billion from Bloomberg surveys. The company blames potential headwinds from prediction markets and regulatory shifts, but highlights strengths in international markets like the UK and Australia.

- Key growth drivers for next year include expanding iGaming in new states.

- Investments in tech to integrate prediction-style betting could help regain momentum.

- Share buybacks totaled $1 billion in 2025, signaling confidence in long-term value.

EPS for Q4 came in at $1.74, missing the $1.91 forecast by nearly 9%. Profit margins squeezed due to higher marketing spends to combat competition.

As the U.S. market matures, Flutter must adapt quickly. The rise of these new platforms could reshape how fans engage with sports, forcing traditional players to innovate or risk fading.

Flutter’s story is one of triumph turned tension, as the thrill of sports betting faces fresh rivals. The revenue miss spotlights a pivotal moment for the industry, where innovation could spell survival. This shift affects everyday bettors too, potentially offering more choices but also raising questions about responsible gaming in a crowded field.