Alabama’s push for legal gambling hits another wall as state leaders declare no momentum for bills in the 2026 session. This setback leaves residents waiting longer for potential lottery and sports betting options, raising questions about when change might finally come.

State lawmakers kicked off the 2026 legislative session this week with a clear message: gambling legislation lacks the backing to move forward. Senate President Pro Tem Garlan Gudger told reporters his gut feeling is that no proposals will surface this year. He pointed to weak support among colleagues as the main roadblock.

House Speaker Nathaniel Ledbetter echoed those thoughts. He noted that no active bills exist in the House, and any effort would need to start in the Senate. Ledbetter mentioned he hasn’t even discussed gambling with Gudger recently, signaling a low priority for the topic.

This standstill marks another chapter in Alabama’s long struggle with gambling reform. Past sessions saw heated debates, but bills often died without a vote.

In recent years, efforts to legalize sports betting, casinos, and a state lottery have gained some traction but ultimately failed. For instance, a 2024 House bill passed but got gutted in the Senate committee, stopping progress cold.

Why Support Remains Weak for Change

Several factors explain the ongoing resistance to gambling laws in Alabama. Conservative values play a big role, with many lawmakers viewing expanded gaming as a moral issue. They worry it could lead to addiction and social problems in communities.

Economic arguments cut both ways. Supporters highlight potential revenue, like the estimated $510 million to $710 million from a lottery, casinos, and sports betting, based on a 2020 study by Governor Kay Ivey’s group. That money could fund education and infrastructure.

Opponents argue the risks outweigh the benefits. They point to illegal gambling rings that already operate in the state, suggesting legalization might not curb those issues.

One key voice pushing for a vote is Senator Tommy Tuberville. The former football coach believes voters deserve a say through a public referendum. He supports a lottery, noting Alabama is one of just five states without one.

Public opinion shows mixed feelings. Polls from recent years indicate many Alabamians favor a lottery for education funding, but casino and betting expansions spark more debate.

Past Attempts and Broader U.S. Trends

Alabama’s gambling history is full of near misses. In 2021, the Senate approved a bill for a lottery, casinos, and sports betting, but it stalled in the House. Similar pushes in 2024 advanced in one chamber only to fail in the other.

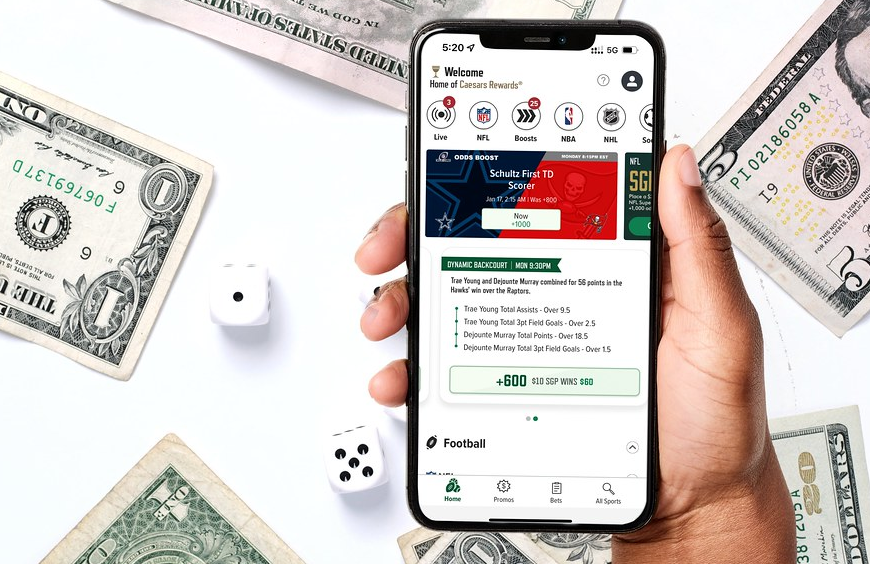

Nationwide, sports betting has exploded since a 2018 Supreme Court ruling opened the door. Over 30 states now allow it, generating billions in revenue. Neighboring Georgia is eyeing mobile sports betting bills for 2026, without needing a voter referendum.

In Alabama, the absence of legal options drives residents to illegal bookies or out-of-state apps. This underground market thrives, especially during big events like college football games involving local teams.

Experts estimate the state loses out on millions in untapped taxes. A 2025 report from the Sports Business Journal noted that states without legal betting miss revenue that could support public services.

Here’s a quick look at Alabama’s gambling status compared to neighbors:

- Florida: Allows sports betting and casinos.

- Georgia: Debating mobile betting legalization.

- Mississippi: Has casinos and sports betting.

- Tennessee: Legal sports betting since 2020.

This contrast puts pressure on Alabama leaders to reconsider.

What This Means for Residents and the Future

For everyday Alabamians, the delay means continued frustration. Many cross state lines to place bets or buy lottery tickets, boosting other economies instead.

Business owners in tourism and entertainment sectors feel the pinch too. Legal gambling could create jobs and attract visitors, but without action, those opportunities slip away.

Looking ahead, some lawmakers hint at future possibilities. Representative Phillip Ensler has said he would champion gambling bills if he becomes lieutenant governor. He focuses on improving quality of life through such reforms.

Advocacy groups like Alabama Arise push for priorities including workers’ rights and education, sometimes tying in gambling revenue as a funding source.

Still, the fast-paced 2026 session, with eyes on upcoming elections, might sideline divisive issues like this.

The inaction in Alabama’s 2026 session underscores a deeper divide on gambling, where potential economic gains clash with longstanding concerns. As other states race ahead with legalization, Alabama risks falling further behind, leaving residents to wonder if real change will ever arrive.